Budget

The Budget of the AAP Delhi Government nearly doubled from 31,000 Cr in 2014-15 to 60,000 Cr in 2019-20 without any new taxes imposed.

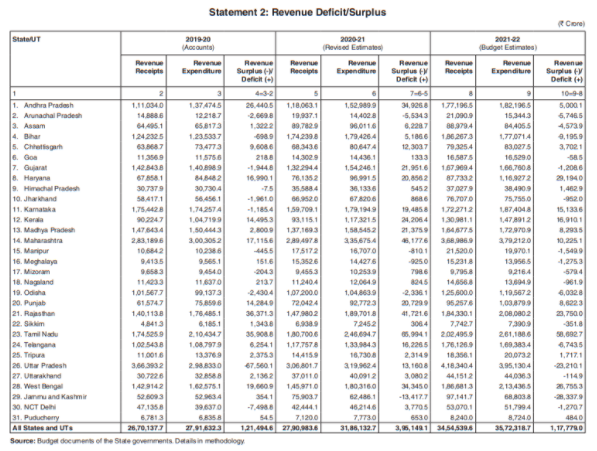

Revenue Surplus

Delhi Government has maintained a consistent Revenue Surplus which was Rs 7,499 Cr during 2019-20 as compared to Rs 6,261 Cr during 2018-19. This is in spite of not increasing any taxes since 2015, and despite several welfare schemes.

Outstanding Liabilities

The AAP Government has cleared most of the outstanding liabilities that were there when they came to power in Feb 2015.

Outstanding liabilities on Delhi at the end of FY 2014-15 was Rs 32,497.9 cr. By end of FY 2019-20, this was brought down to Rs 3,631.4 crore – a decrease of almost 89% since 2015.

This is also the lowest amongst all the states.

(Source: Figure. 39 – State of State Finances: 2020-2021)

Increased Revenue

Delhi government’s tax revenues grew by about 66% from 26,604 crore in 2014-15 to 44,100 crore (BE) in 2020-21.

It grew at the rate of 12% CAGR between 2014-19 under the AAP government (as against 10% CAGR between 2011-15 under the previous government).

Source: Dialogue & Development Commission Compendium – January 2020, Page 134

Some of the policy decisions which resulted in this higher tax collection:

- Stopping raid raj in Delhi – The AAP government stopped harassment of businesspersons by tax officers/inspectors, as a result of which tax money went into the public coffers instead of pockets of officers, bureaucrats and politicians. This increased the tax collection. Please find more details about this in “Governance” section.

- Lower the tax, higher the compliance – The AAP government lowered the tax rates, thereby improving the tax compliance. This further added to the tax collection.

- Basic reforms in Excise policy made between 2014-15 and 2017-18 greatly reduced theft/corruption and increased the excise revenue from 3,400 cr to 5,200 Cr during the first 3 years.

By making just a single change of daily random posting of the excise inspectors in the 1st year, the excise revenue increased from 3,400 Cr in 2014-15 to 4,238 Cr in 2015-16.

Also, 3,977 illegal liquor shops were shut down, due to which excise revenue leakage was arrested, thereby increasing the revenues further.

- New Excise Policy of Dec 2021: In the new excise policy, excise revenue from liquor has increased from 6,000 Cr to more than 9,500 Cr. For more details, please look at the “Governance” section.

- Energy Infrastructure expansion helped reduce AT&C losses from 17% in 2013 to below 8%. Reduction of energy theft is one of the reasons behind this, which also resulted in adding 20% legal connections thereby adding to the revenues of discoms and the Delhi government. Please find more details about this in “Electricity” section.

- Water & Sanitation Infrastructure expansion and eliminating Tanker Mafia, increasing the number of metered consumers by 71% thereby reducing the losses and improving the revenues for Delhi Jal Board. Please find more details about this in “Water – Outputs and Outcomes” section.

- Ease of doing business policies further resulted in increase of new business, which indirectly resulted in government revenues. Please find more details about these policies in “Jobs & Economy” section.

Achievements Under Outcome Budget

Status of Outcome Budget 2020-21

Outcome Budget 2020-21 of GNCTD covers 80% of the budget outlay across all major departments (38) and agencies, combined into 8 major sectors. There are a total number of 595 schemes which contain 1391 unique Output indicators and 1122 unique Outcome indicators.

Progress of each department on the basis of the performance of output and outcome indicators has been graded as below.

ON TRACK: Min 75% progress against target up to Dec 2020

OFF TRACK: <75% progress against target